Selling an industrial products company comes with distinct challenges that shape both the process and the final outcome. Unlike other businesses, industrial companies are deeply influenced by specialized equipment, long-term contracts, and market demand specific to their sector.

Owners must navigate complex assets, client relationships, and workforce issues unique to this industry. Here’s a breakdown of what sellers need to know about valuing assets, handling industrial property sales, and employing strategies that impact negotiations and maximize results. Tips from experienced M&A advisors and business brokers in Arizona.

Defining Industrial Selling and Its Unique Characteristics

Industrial selling describes transactions involving businesses that manufacture, distribute, or sell products used in manufacturing, construction, or other industrial activities. It involves specialized equipment, bulk orders, and complex supply chains. Unlike retail or consumer sales, industrial selling focuses on business-to-business relationships and contracts with longer durations.

This distinction affects how an industrial products company is prepared for sale. Buyers expect detailed documentation of operational capacity, client contracts, and inventory levels. Pricing methods differ too, as asset value, order backlog, and intellectual property may weigh heavily in negotiations. Recognizing these traits helps sellers position their businesses effectively in the market.

Preparing Financials and Asset Documentation

Financial records play a major role in selling an industrial products company. Buyers scrutinize profit margins, cash flow stability, and cost structures. Detailed profit and loss statements, balance sheets, and tax returns from recent years give insight into performance trends.

Unlike many service businesses, industrial firms hold significant tangible assets like machinery, warehouses, and vehicles. Documenting these assets accurately impacts business valuation. Sellers should provide up-to-date appraisals and maintenance histories to show equipment condition and replacement costs.

Inventory management also matters. Buyers want to confirm that stock levels match reported values and that raw materials or finished goods align with market demand. Transparency in financial and asset records accelerates buyer confidence.

Valuing Industrial Property and Real Estate

Selling industrial property can be part of the overall transaction or a separate deal. Industrial real estate includes manufacturing plants, storage warehouses, or specialized production facilities. These properties have unique features such as loading docks, heavy power supplies, or zoning approvals.

Industrial property value depends on location, size, condition, and local market demand. Properties in logistics hubs or near major transport routes usually command higher prices. Sellers should obtain professional appraisals and prepare clear title documents.

When the property is sold alongside the business, buyers consider the combined value. Leasing property separately might attract different buyer pools or influence financing options. Accurate industrial real estate valuation supports negotiating a fair price and closing efficiently.

Reviewing Contracts and Client Relationships

Long-term contracts and client relationships form valuable intangible assets in industrial businesses. Buyers assess recurring revenue streams and customer concentration risks. Contracts with reliable, established clients add predictability to future income.

Sellers must gather all relevant agreements, including supply contracts, service commitments, and purchase orders. Detailing renewal terms and any clauses that impact transferability helps buyers assess risks.

Client relationships may involve technical support or customization services. Explaining these elements during negotiations clarifies value beyond just numbers. Strong, documented client ties improve marketability and attract serious offers.

Managing Compliance and Regulatory Requirements

Industrial companies must comply with various regulations related to safety, environmental standards, and labor laws. Buyers expect to see evidence of compliance to avoid liabilities.

Sellers should organize inspection reports, permits, and certifications that confirm adherence to legal standards. Addressing outstanding issues before listing your business for sale can improve offers.

Environmental audits, health and safety records, and zoning compliance all play roles in industrial selling. Failure to disclose problems can cause delays or renegotiations. Demonstrating regulatory compliance shows operational discipline and reduces buyer concerns.

Marketing Strategies for Industrial Selling

Marketing an industrial products company requires reaching the right audience. Buyers may include competitors, private equity firms, or strategic investors focused on industry consolidation.

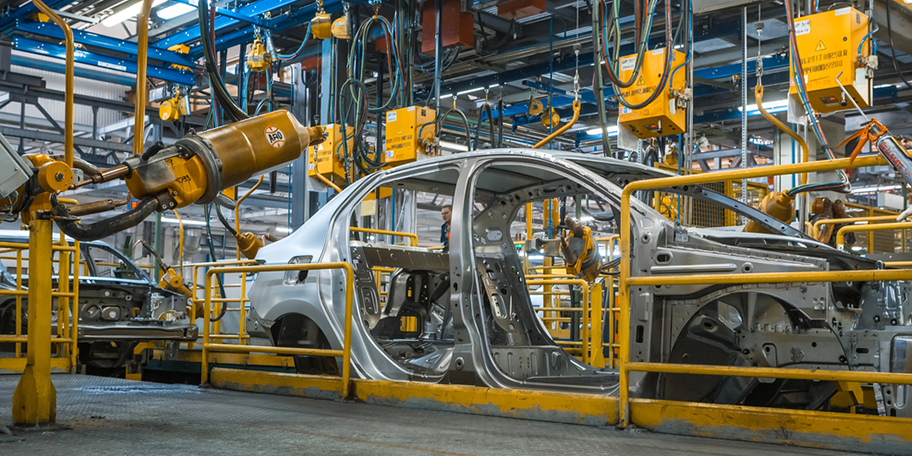

Effective marketing materials highlight production capacity, technology advantages, and client base. Professional photos of facilities and equipment support visual credibility.

Confidentiality matters to sellers to protect relationships and employee morale. Using trusted business brokers with industrial experience helps target qualified buyers while maintaining discretion. Leveraging industry networks and trade associations can expand exposure to motivated buyers.

Sell Your Industrial Business with Experienced Arizona Business Brokers

Selling an industrial products company involves unique considerations related to assets, contracts, and industry regulations. Proper preparation and a strategic approach increase the chance of a successful transaction. With over 35 years of combined experience, Strategic Business Brokers Group offers a trusted approach to selling and buying businesses in Arizona.

We take the time to understand your unique needs before creating a tailored marketing plan aimed at achieving the best possible results for both buyers and sellers. Our team values honesty and confidentiality, working diligently to create deals that benefit all parties involved.

Services include business listings, valuations, transaction management, commercial real estate, and franchise opportunities. As members of the Arizona Business Brokers Association and the International Business Brokers Association, we bring professionalism and proven success to every sale. Contact us to start your journey.